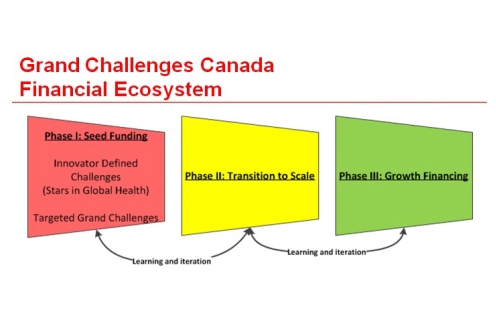

Grand Challenges Canada, which is funded by the Government of Canada, supports Bold Ideas with Big Impact in global health. So how do we balance fostering innovation — with its inherent risk of failure — with scaling impact? Part of the answer lies in our financial ecosystem, shown below.

To stimulate innovation, we fund a large number of grants at the “seed” phase. These grants are $100,000 ($250,000 for our Targeted Challenges). The review resembles traditional peer review, is done virtually, and the reviewers tell us their key focus is on novelty. One of the review criteria is “Integrated Innovation”: the coordinated application of science and technology, social and business innovation. We feel that adding this criterion makes our pipeline more likely to be scalable by addressing these three critical aspects at the front end. We have funded almost 300 projects (of > 1,300 applications) so far in our Stars in Global Health program alone. We agree with Linus Pauling who said, “To have a good idea, you must first have lots of ideas.” We expect some of these ideas to fail. The risk of these projects at Phase I is too great for the private sector and we support 100% as a grant. We feel we are closing the “pioneer gap” identified in the Acumen report titled From Blueprint to Scale: The Case for Philanthropy in Impact Investing.

For these innovations to have impact, they must have scale and sustainability. This is the focus of our “Transition to Scale” phase. These grants or loans repayable on revenues are up to $1M. They require at least 50% matching funding from a “smart partner” who can help to scale the innovation because they bring distribution channels, local knowledge, entrepreneurial experience, etc. The review resembles venture capital through an investment committee, and we conduct intensive due diligence on these deals. To date, our Board has approved seven deals at the transition-to-scale phase.

We recognize that the ~$2M Transition to Scale deals will most likely not be sufficient to scale an innovation. We are currently working on impact investment funds with first loss protection and shared value partnerships for the growth financing stage. At this stage, the risk is less and the goal is to use public funds as “insurance”, not to expend them, and perhaps to gain modest returns. More on this topic in a future blog.

The theoretical basis for this approach can be found in Anne Marie Slaughter’s concept of “government as platform” or Mariana Mazzucato’s idea of the “entrepreneurial state.” Our Stars program is similar in its staging to the approach of Development Innovation Ventures at USAID (and the recently announced G-DIV with DFID UK and Omidyar Foundation), although these programs cover all sectors, do not yet require co-investment, and may not target innovators from the developing world as intensively.

At Grand Challenges Canada, we see ourselves not only as a funder of development innovation but also as a laboratory for innovation in development. Our goal is to create a cohesive ecosystem where the level of public funds matches risk, and use of public funds is targeted to mitigate risk for and crowd in other investors. We are interested in practice-based learning and are already achieving early results. We will report on our experiences in the development of our financial ecosystem. We think it has implications well beyond Grand Challenges Canada.

I would like to acknowledge and thank Peter A. Singer for his role as a co-author of this piece. I encourage you to post your questions and comments about this blog post on our Facebook page Grand Challenges Canada and on Twitter @TaylorAndrew1 @PeterASinger @gchallenges.